Starting from 1st September 2018, Malaysia is implementing The Sales and Services Tax (SST) to replace the Goods and Services Tax (GST). The new tax system imposes a tax of 5 percent and 10 percent on the sale of goods, and a 6 percent levy on services.

With the tax rate of SST seems a lot higher, it is essential for us to know that the new tax system exempts a total of 5,443 items compared to 545 items under GST.

However, courier delivery services do not fall under the exempted category. This article will give some insights on how SST will affect the courier delivery services.

First, what is SST again?

As many people might not aware, SST stands for Sales Tax and Service Tax, which is two different taxes.

Sales Tax is a single stage tax levied on imported and locally manufactured goods, either at the time of importation or at the time the goods are sold or otherwise disposed of by the manufacturer.

Service Tax is a tax charged and levied on taxable services provided by any taxable person in Malaysia in the course and furtherance of business.

What is the difference between GST and SST?

GST is a multi-stage tax, which it covers every stage of the supply chain. Every business is required to charge and collect the tax on any sales of products or services. However, the suppliers will be able to claim back from the government.

Meanwhile, SST is a single stage tax that only applies to suppliers or service providers and apply to a narrower set of goods and services.

What is the rate of Service Tax for the courier delivery service?

Courier delivery services shall be charged for 6% service tax under the following criteria:

- The delivery of a parcel or document not exceeding 30kg if it is delivered:

– From an area in Malaysia to another area in Malaysia

– From an area in Malaysia to Labuan, Tioman and Langkawi, or vice versa

– From an area in Malaysia to any free zone, licensed warehouse and licensed manufacturing warehouse and Joint Development Area, or vice versa - Courier delivery services include parcel, prepaid box and prepaid envelope and other related services.

Are there any courier services exempted from the Service Tax?

Under the following circumstances, courier delivery services will be exempted from the Service Tax:

- Any delivery above 30kg will be exempted from the service tax of courier delivery

- The delivery of a parcel or document if it is delivered:

– From an area outside Malaysia to another area outside Malaysia

– From an area within Malaysia to another area outside Malaysia

– From an area outside Malaysia to another area within Malaysia

What can we expect after the implementation of SST on the courier delivery services?

We can expect that most of the courier delivery service providers will incur SST into their services, with Pos Malaysia has also recently announced on their website.

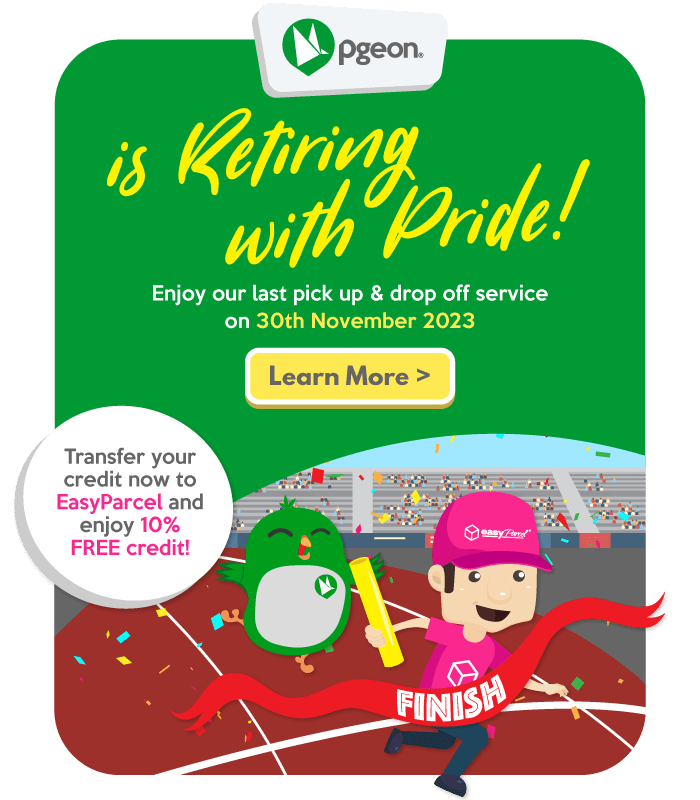

Even after the implementation of SST, Pgeon remains the price of RM5.50 for Point delivery and RM5.90 for Door-to-Door delivery.

SST will applicable for top-up only.

Now, you can even deliver your parcel within Penang, KL, Selangor and Johor at the lowest rate in Malaysia for 5kg parcel and below!

So, what are you waiting? Sign up now and start delivering with Pgeon.